Tidewater Renewables Ltd. Announces September 30, 2021 Quarterly Results and Operational Update

Nov. 4, 2021

Tidewater Renewables Ltd. (“Tidewater Renewables” or the “Corporation”) (TSX: LCFS) is pleased to announce that it has filed its condensed interim financial statements and Management’s Discussion and Analysis (“MD&A”) for the three months ended September 30, 2021. The Corporation filed a supplemented PREP prospectus dated August 12, 2021 (the “Prospectus”), an electronic copy of which is available on Tidewater Renewables SEDAR profile at www.sedar.com.

FINANCIAL PERFORMANCE

Highlights

- On August 18, 2021, Tidewater Renewables completed its initial public offering (the “Offering”) of 10 million common shares at a price of $15.00 per common share (the “Offering Price”), for total gross proceeds of $150 million. On September 15, 2021, the underwriters partially exercised the over-allotment option and issued an additional 735,000 common shares at the Offering Price for additional gross proceeds of $11 million. The partial exercise of the over-allotment option increased the total gross proceeds of the Offering to $161 million. Underwriter commissions were 6% of the total gross proceeds raised from the Offering. Following the closing of the over-allotment option there were 34,635,000 Common Shares outstanding, of which Tidewater Midstream and Infrastructure Ltd. (“Tidewater Midstream”) held approximately 69%. In total, Tidewater Renewables received approximately $150 million in cash consideration net of underwriter commissions and legal expenses.

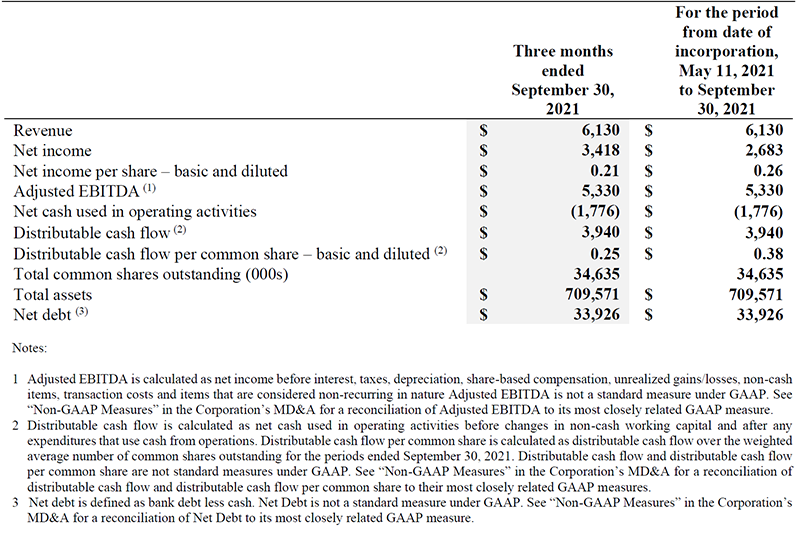

- Tidewater Renewables generated $5.3 million of Adjusted EBITDA in its first 44 days of operations. Net income was $3.4 million for the third quarter of 2021. Net cash used in operating activities totaled $1.8 million for the third quarter of 2021, with distributable cash flow of $3.9 million.

- With the closing of the Offering, Tidewater Renewables announced a positive final investment decision on the Corporation’s 3,000 bbl/d Renewable Diesel and Renewable Hydrogen Complex (as defined and described in the Prospectus), which is expected to enter into service in the first quarter of 2023. Subsequent to September 30, 2021, the Corporation received its first milestone and plans to submit its second milestone in November 2021, under the executed Renewable Diesel Project Part 3 Agreement, as described in the Prospectus. Management anticipates the Renewable Diesel & Renewable Hydrogen Complex will generate approximately $90 - $95 million of Adjusted EBITDA in 2023 on a full year run-rate basis based on certain operating assumptions that are fully described in the Prospectus.

- The Canola Co-Processing project achieved successful commissioning and start-up, slightly ahead of its planned schedule, and production of renewable diesel has commenced.

Selected financial and operating information is outlined below and should be read with the Corporation’s condensed interim financial statements and related MD&A as at and for the three months ended September 30, 2021 and the period from date of incorporation, May 11, 2021 to September 30, 2021 which are available at www.sedar.com and on our website at www.tidewater-renewables.com.

OUTLOOK AND CAPITAL PROGRAM

During the third quarter of 2021, Tidewater Renewables achieved several milestones including the closing of the Offering on August 18, 2021, reaching a positive final investment decision of the 3,000 bbl/d Renewable Diesel and Renewable Hydrogen Complex, and successfully commissioning the Canola Co-Processing Project. Tidewater Renewables continues to execute successfully on its strategy by expanding its integrated network of assets with disciplined capital allocation.

Canola Co-processing Project

During the third quarter of 2021, the Canola Co-Processing project achieved successful commissioning and start-up, slightly ahead of its planned schedule and first production of renewable diesel was monetized. Canola Co-Processing achieved an average and maximum rate of 200 and 250 bbl/d, respectively, during the third quarter while commissioning was ongoing.

Renewable Diesel and Renewable Hydrogen Complex

The Renewable Diesel and Hydrogen Complex project remains on time and on budget. The 3,000 bbl/d facility is expected to enter service in Q1 2023.

During the third quarter following significant project milestones were achieved:

- submitted and received the first milestone (14,276 BC LCFS credits) under the executed Renewable Diesel Project Part 3 Agreement with the Government of British Columbia;

- received rezoning covenant sign off by the City of Prince George and submitted it to land titles;

- ordered long-lead equipment such as reactors, stripping towers, storage tanks, pressure swing adsorption unit, boiler equipment, electrical buildings, and pre-treatment equipment;

- completed surface preparation including tree clearing and removal;

- completed geotechnical study, rough grade, access road and approximately 50% of site gravelling;

- underground fire water lines and oily water drains installation; and

- submitted Ministry of Environment & Climate Change Strategy application.

Management expects to achieve the following construction project milestones within the next three to six months:

- complete underground line installation;

- start brownfield pipe rack construction to connect existing refinery utilities, tanks and loading infrastructure to HDRD construction site;

- finish tank concrete foundations and begin erecting storage tanks;

- award medium lead items including compressors, pumps, heat exchangers and flare system; and

- start piping and instrumentation design and issue related construction packages.

QUARTER 2021 EARNINGS CALL

In conjunction with the earnings release, investors will have the opportunity to listen to Tidewater Renewables’ senior management review its quarter 2021 results via conference call on Thursday, November 4, 2021 at 10:00 am MDT (12:00 pm EDT).

To access the conference call by telephone, dial 416-764-8659 (local / international participant dial in) or 1-888-664-6392 (North American toll free participant dial in). A question and answer session for analysts will follow management's presentation.

A live audio webcast of the conference call will be available by following this link: https://produceredition.webcasts.com/starthere.jsp?ei=1506688&tp_key=85fe2617f2 and will also be archived there for 90 days.

For those accessing the call via Cision's investor website, we suggest logging in at least 15 minutes prior to the start of the live event. For those dialing in, participants should ask to be joined into the Tidewater Renewables Ltd. earnings call.

ABOUT TIDEWATER RENEWABLES

Tidewater Renewables is traded on the TSX under the symbol “LCFS”. Tidewater Renewables is a multi-faceted, energy transition company. The Corporation is focused on the production of low carbon fuels, including renewable diesel, renewable hydrogen and renewable natural gas, as well as carbon capture through future initiatives. The Corporation was created in response to the growing demand for renewable fuels in North America and to capitalize on its potential to efficiently turn a wide variety of renewable feedstocks (such as tallow, used cooking oil, distillers corn oil, soybean oil, canola oil and other biomasses) into low carbon fuels. Tidewater Renewables’ objective is to become one of the leading Canadian renewable fuel producers. The Corporation is pursuing this objective through the ownership, development, and operation of clean fuels projects and related infrastructure, utilizing existing proven technologies. Organically, Tidewater Renewables will seek to leverage the existing infrastructure and engineering expertise of Tidewater Midstream, its majority shareholder, regarding the development of the Corporation’s portfolio of greenfield and brownfield capital projects as well as the expansion of the Corporation’s product offerings. Additional information relating to Tidewater Renewables is available on SEDAR at www.sedar.com and at www.tidewater-renewables.com.

Advisory Regarding Forward-Looking Statements

Certain statements contained in this press release constitute forward-looking statements and forward-looking information (collectively referred to herein as, “forward-looking statements”) within the meaning of applicable Canadian securities laws. Such forward-looking statements relate to future events, conditions or future financial performance of Tidewater Renewables based on future economic conditions and courses of action. All statements other than statements of historical fact may be forward-looking statements. Such forward-looking statements are often, but not always, identified by the use of any words such as “seek”, “anticipate”, “budget”, “plan”, “continue”, “forecast”, “estimate”, “expect”, “may”, “will”, “project”, “predict”, “potential”, “targeting”, “intend”, “could”, “might”, “should”, “believe”, “will likely result”, “are expected to”, “will continue”, “is anticipated”, “believes”, “estimated”, “intends”, “plans”, “projection”, “outlook” and similar expressions. These statements involve known and unknown risks, assumptions, uncertainties and other factors that may cause actual results or events to differ materially from those anticipated in such forward-looking statements. The Corporation believes the expectations reflected in those forward-looking statements are reasonable, but no assurance can be given that these expectations will prove to be correct and such forward-looking statements included in this press release should not be unduly relied upon.

In particular, this press release contains forward-looking statements pertaining to, but not limited to, the following:

- the expected financial performance of the Corporation’s proposed capital projects and assets following the commencement of operations, including underlying assumptions;

- estimates of EBITDA and Run Rate EBITDA;

- the Corporation’s business plans and strategies, including the underlying existing assets and capital projects, the success and timing of the projects;

- the Corporation’s operational and financial performance, including expectations regarding generating revenue, revenues and operating expenses;

- the Corporation’s objective to become the one of the leading Canadian renewable fuel producers;

- ability of proven technologies to be applied to generate clean fuels;

- ability to leverage existing infrastructure and engineering expertise of Tidewater Midstream regarding development of the Corporation’s projects and product offerings;

- ability to supply low carbon fuels to investment grade offtakers, existing customers, government entities, First Nations groups and others;

- changes in governmental programs, policymaking and requirements or encouraged use of biofuels, including renewable fuel policies in Canada and the United States and Europe, and government level programs, such as BC LCFS and Canada’s CFS;

- the future pricing of BC LCFS Credits and CFS Credits;

- expectations around the Corporation’s receipt of BC LCFS Credits and CFS Credits;

- the availability, future price and volatility of feedstocks and other inputs;

- the future price and volatility of commodities;

- the Acquired Assets ability to generate operating cash flows;

- the expectation that the Corporation will be able to grow its revenue, actively maintain and manage its Acquired Assets and achieve external growth by selectively pursuing strategic business development opportunities;

- the amount and timing of anticipated payments of revenue to be received from Tidewater Midstream and other counterparties, and that revenues from the Acquired Assets will provide a significant portion of the Corporation’s revenue;

- the performance and creditworthiness of the Corporation’s counterparties;

- the anticipated operating costs, capital costs, environmental liabilities and reclamation obligations associated with owning and operating renewable energy production and infrastructure assets to be incurred by the Corporation;

- utilization rates and throughputs of the Acquired Assets;

- operational matters, including potential hazards inherent in the Corporation’s operations and the effectiveness of third-party health, safety, environmental and integrity programs;

- decommissioning, abandonment and reclamation costs;

- the Corporation’s ability to grow through capital projects;

- the long-term impact of COVID-19 on the Corporation’s business, financial position, results of operations and/or cash flows;

- supply and demand for commodities and services;

- budgets, including future capital, operating or other expenditures and projected costs;

- the Corporation’s continuing evaluation of opportunities to develop future low-carbon fuel and renewable energy projects and expansion and optimization opportunities at the PGR;

- timing, impact and capital requirements of the projects at PGR;

- the Corporation’s focus on generating cash flow;

- the Corporation’s ESG strategy, including the ability of renewable products to deliver CI reduction alternatives; and

- expectations that net cash provided by operating activities, cash flow generated from growth projects and cash available from Tidewater Renewables’ Senior Credit Facility and other sources of financing will be sufficient to meet its obligations and financial commitments and will provide sufficient funding for anticipated capital expenditures.

Although the forward-looking statements contained in this MD&A are based upon assumptions which management of the Corporation believes to be reasonable, the Corporation cannot assure investors that actual results will be consistent with these forward-looking statements. With respect to forward-looking statements contained in this MD&A, the Corporation has made assumptions regarding, but not limited to:

- Tidewater Renewables’ ability to execute on its business plan;

- the timely receipt of all third party, governmental and regulatory approvals and consents sought by the Corporation including with respect to the Corporation’s projects and applications;

- general economic and industry trends, including the duration and effect of the COVID-19 pandemic;

- operating assumptions relating to the Corporation’s projects;

- the Corporation’s projects may not generate expected levels of output, including those resulting from a reduced feedstock supply;

- the ownership and operation of Tidewater Renewables’ business;

- regulatory risks, including changes or delay to the BC LCFS Credits or CFS Credits;

- the expansion of production of renewable fuels by competitors;

- the future pricing of BC LCFS Credits and CFS Credits;

- future commodity prices;

- sustained or growing demand for renewable fuels;

- ability for the Corporation to successfully turn a wide variety of renewable feedstocks into low carbon fuels;

- continuing government support for existing policy initiatives;

- processing and marketing margins;

- future capital expenditures to be made by the Corporation;

- foreign currency, exchange and interest rates;

- that there are no unforeseen events preventing the performance of contracts;

- that formal agreements with counterparties will be honored;

- the Corporation’s ability to obtain and retain qualified staff and equipment in a timely and cost-effective manner;

- assumptions regarding amount of operating costs for the Corporation’s projects;

- that there are no unforeseen material costs relating to the projects which are not recoverable;

- distributable cash flow and net cash provided by operating activities are consistent with expectations;

- the ability to obtain additional financing on satisfactory terms;

- the ability of Tidewater Renewables to successfully market its products;

- timely receipt of equipment and goods ordered by the Corporation to conduct its operations;

- impact of planned annual maintenance on the Corporation’s facilities;

- forecasts with respect to future environmental and climate change compliance obligation costs, and success of same; and

- satisfaction of covenants under the Corporation’s Senior Credit Facility;

- the Corporation’s future debt levels and the ability of the Corporation to repay its debt when due.

The Corporation’s actual results could differ materially from those anticipated in the forward-looking statements, as a result of numerous known and unknown risks and uncertainties and other factors including, but not limited to:

- changes in supply and demand for low carbon products;

- risks of health epidemics, pandemics and similar outbreaks, including COVID-19, which may have sustained material adverse effects on the Corporation’s business, financial position, results of operations and/or cash flows;

- risks and liabilities inherent in the operations related to renewable energy production and storage infrastructure assets, including the lack of operating history and risks associated with forecasting future performance;

- competition for, among other things, third-party capital and acquisitions of additional assets;

- risks related to the environment and changing environmental laws in relation to the operations conducted with the Acquired Assets;

- geological, technical, drilling, processing and handling issues associated with renewable energy production and storage development activities by third parties;

- risks arising from co-ownership of facilities including reliance on third-party operators;

- changes in the performance or creditworthiness of counterparties;

- risks and liabilities associated with the processing and handling of dangerous goods;

- risks relating to supply chain disruptions;

- inadvertent non-compliance with applicable regulations;

- climate change risks, including the effects of unusual weather and natural catastrophes, costs associated with regulatory and market compliance, and potential changes in climate change initiatives and policies or increased environmental regulation;

- reputational risks;

- technology and security risks, including cybersecurity;

- First Nations and landowner consultation requirements;

- disruptions in production, including work stoppages or other labour difficulties, or disruptions in the transportation network on which the Corporation is reliant;

- technical and processing problems, including the availability of equipment and access to properties;

- claims made or legal actions brought or realized against the Corporation or its properties or assets;

- a failure by the Corporation to hire or retain key personnel, and reliance on key personnel;

- changes in tax or environmental laws or credit or incentive programs relating to the renewable oil and natural gas industry;

- general economic, political, market and business conditions, including fluctuations in interest rates, foreign exchange rates stock market volatility and supply/demand trends;

- activities of producers and customers and overall industry activity levels;

- failure to negotiate and conclude any required commercial agreements;

- non-performance of agreements in accordance with their terms;

- failure to execute formal agreements with counterparties in circumstances where letters of intent or similar agreements have been executed and announced by Tidewater Renewables;

- that the resolution of any particular legal proceedings could have an adverse effect on the Corporation’s operating results or financial performance;

- competition for, among other things, business capital, acquisition opportunities, requests for proposals, materials, equipment, labour, and skilled personnel;

- the ability to secure land and water, including obtaining and maintaining land access rights;

- operational matters, including potential hazards inherent in the Corporation's operations and the effectiveness of health, safety, environmental and integrity programs;

- actions by governmental authorities, including changes in government regulation, tariffs and taxation;

- changes in operating and capital costs, including fluctuations in input costs;

- legal, transportation and environmental risks and hazards, which may create liabilities to the Corporation in excess of the Corporation's insurance coverage, if any;

- actions by joint venture partners or other partners which hold interests in certain of the Corporation’s assets;

- reliance on key relationships and agreements, including with Tidewater Midstream;

- construction and engineering variables associated with capital projects, including the availability of services, accuracy of estimates and schedules, and the performance of contractors;

- the availability of capital on acceptable terms;

- risks and liabilities resulting from derailments;

- changes in gas composition; and

- failure to realize the anticipated benefits of recently completed acquisitions.

The foregoing lists are not exhaustive. Additional information on these and other factors which could affect the Corporation’s operations or financial results are included in the Corporation’s Prospectus and in other documents on file with the Canadian Securities regulatory authorities.

Management of the Corporation has included the above summary of assumptions and risks related to forward-looking statements provided in this press release in order to provide holders of common shares in the capital of the Corporation with a more complete perspective on the Corporation’s current and future operations, and such information may not be appropriate for other purposes.

The Corporation’s actual results’ performance or achievement could differ materially from those expressed in, or implied by, these forward-looking statements and, accordingly, no assurance can be given that any of the events anticipated by the forward-looking statements will transpire or occur, or if any of them do so, what benefits the Corporation will derive therefrom. Readers are therefore cautioned that the foregoing list of important factors is not exhaustive, and they should not unduly rely on the forward-looking statements included in this press release. Tidewater Renewables does not undertake any obligation to update publicly or to revise any of the included forward-looking statements, whether as a result of new information, future events or otherwise, other than as required by applicable securities law. All forward-looking statements contained in this press release are expressly qualified by this cautionary statement. Further information about factors affecting forward-looking statements and management’s assumptions and analysis thereof is available in filings made by the Corporation with Canadian provincial securities commissions available on the System for Electronic Document Analysis and Retrieval (“SEDAR”) at www.sedar.com.

Non-GAAP Measures

This press release refers to “Adjusted EBITDA” which does not have any standardized meaning prescribed by generally accepted accounting principles in Canada (“GAAP”). Adjusted EBITDA is calculated as income or loss before interest, taxes, depreciation, share-based compensation, unrealized gains/losses, non-cash items, transaction cost and items that are considered non- recurring in nature.

Tidewater Renewables’ management believes that Adjusted EBITDA provides useful information to investors as it provides an indication of results generated from the Corporation’s operating activities prior to financing, taxation and non-recurring/non-cash impairment charges occurring outside the normal course of business. Adjusted EBITDA is used by management to set objectives, make operating and capital investment decisions, monitor debt covenants and assess performance. In addition to its use by management, Tidewater Renewables’ also believes Adjusted EBITDA is a measure widely used by security analysts, investors and others to evaluate the financial performance of the Corporation and other companies in the renewable industry. Investors should be cautioned that Adjusted EBITDA should not be construed as alternatives to earnings, cash flow from operating activities or other measures of financial results determined in accordance with GAAP as an indicator of the Corporation’s performance and may not be comparable to companies with similar calculations.

"Distributable cash flow" is a non-GAAP financial measure and is calculated as net cash used in operating activities before changes in non-cash working capital plus cash distributions from investments, transaction costs, non-recurring expenses and after any expenditures that use cash from operations. Changes in non-cash working capital are excluded from the determination of distributable cash flow because they are primarily the result of seasonal fluctuations or other temporary changes and are generally funded with short term debt or cash flows from operating activities. Deducted from distributable cash flow are maintenance capital expenditures, including turnarounds as they are ongoing recurring expenditures. Transaction costs are added back as they vary significantly quarter to quarter based on the Corporation's acquisition and disposition activity. It also excludes non-recurring transactions that do not reflect Tidewater Renewables’ ongoing operations.

Management of the Corporation believes distributable cash flow is a useful metric for investors when assessing the amount of cash flow generated from normal operations and to evaluate the adequacy of internally generated cash flow to fund dividends (however the Corporation currently does not pay a dividend).

For more information with respect to financial measures which have not been defined by GAAP, including reconciliations to the closest comparable GAAP measure, see the “Non-GAAP Measures” section of Tidewater Renewables’ most recent MD&A which is available on SEDAR.

For further information:

Joel MacLeod

Executive Chairman and CEO

Tidewater Renewables Ltd. Phone: 587.475.0210

Email: jmacleod@tidewatermidstream.com